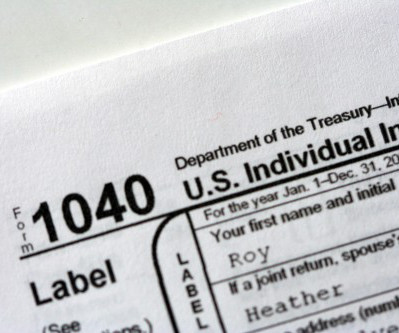

Demystifying Government Contract Requirements: A Guide for New Businesses.

SMBAccountant

FEBRUARY 19, 2024

Understanding the basics of government contracts is essential when engaging in contractual agreements with government entities. Attention to detail, alignment with legal requirements, and effective communication are crucial aspects of navigating government contracts, contributing to successful and compliant contractual engagements.

Let's personalize your content